Category: Society Page 25 of 69

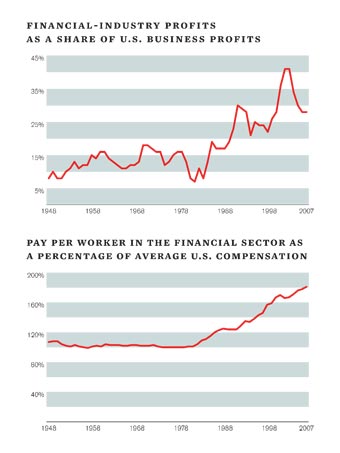

Around September, when this mess was getting some play in the public eye, I used to joke that it wouldn’t be such a bad thing if the financial industry just blew up. That we could rebuild something much better from the pieces than what we had with the present whole. I still say that. I’m not so sure I’m joking all that much anymore. Two graphs, from a story in the Atlantic:

The numbers at the bottom are 10 year terms, starting in 1948. And yes, that uptick starts around 1980. From the article, titled The Quiet Coup, by former IMF chief economist Simon Johnson, is summarized:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform.

Break it. Blow it up. Let’s just have a plan for putting it back together beforehand, yes? And one more suggestion: don’t leave that plan to the people who put us here in the first place. (Of course, that’s the even bigger joke, right there – yes, there’s a problem, but who’s going to fix it? Not the people in power now. This is the hand that fed (and clothed, and housed, and . . .).)

Like a blind squirrel finding a nut, Virginia adopts a smart policy with respect to future development:

Virginia is taking aim at one of the most enduring symbols of suburbia: the cul-de-sac.

The state has decided that all new subdivisions must have through streets linking them with neighboring subdivisions, schools and shopping areas. State officials say the new regulations will improve safety and accessibility and save money: No more single entrances and exits onto clogged secondary roads. Quicker responses by emergency vehicles. Lower road maintenance costs for governments.

Although cul-de-sacs will remain part of the suburban landscape for years to come, the Virginia regulations attack what the cul-de-sac has come to represent: quasi-private standalone developments around the country that are missing only a fence and a sign that says “Keep Out.”

Good move. I hope this becomes a national standard.

Cory Doctorow points us to this new poster campaign by the London’s Metropolitan Police Service:

The text from that poster reads: “A bomb won’t go off here because weeks before a shopper reported someone studying the CCTV cameras.” And there are others, including one that has a picture of a trashcan outside of a home, and reads: “These chemicals won’t be used in a bomb because a neighbor reported the dumped containers.” Yes, folks, unless you report people that look up in public spaces and snoop in your neighbors garbage, the TERRORISTS WILL WIN.  Cory goes to town:

It’s hard to imagine a worse, more socially corrosive campaign. Telling people to rummage in one another’s trash and report on anything they don’t understand is a recipe for flooding the police with bad reports from ignorant people who end up bringing down anti-terror cops on their neighbors who keep tropical fish, paint in oils, are amateur chemists, or who just do something outside of the narrow experience of the least adventurous person on their street. Essentially, this redefines “suspicious” as anything outside of the direct experience of the most frightened, ignorant and foolish people in any neighborhood.

And I don’t think that’s exaggerating the baseline that this campaign is working to create.  Which brings us to the heart of it:

The British authorities are bent on driving fear into the hearts of Britons: fear of terrorists, immigrants, pedophiles, children, knives… And once people are afraid enough, they’ll write government a blank check to expand its authority without sense or limit.

This is one of the central reasons I think Labour deserves to lose the government. But that is for another time. Finally, Cory identifies one of the (many) things that makes this so disappointing:

What an embarrassment from the country whose level-headed response to the Blitz was “Keep Calm and Carry On” — how has that sensible motto been replaced with “When in trouble or in doubt/Run in circles scream and shout”?

Not only has the sun set, but we’re moving well into the night.

So, there’s a:

peace conference [to be held in South Africa, that is] billed as an opportunity to showcase South Africa’s role as a human-rights champion ahead of its hosting of soccer’s World Cup next year. It was to bring together Noble Laureates and top soccer officials. In addition to Tutu and De Klerk, laureates Nelson Mandela and Martti Ahtisaar, Sepp Blatter, president of soccer’s international governing body, and actress Charlize Theron were invited to attend. The event had the blessing of the Nobel Committee.

Okay, sounds like a good idea. Except:

South Africa has refused the Dalai Lama a visa to attend [the] peace conference in Johannesburg this week, a presidential spokesman said.

The Tibetan spiritual leader and Nobel Laureate did not receive a visa because it was not in South Africa’s interest for him to attend, said Thabo Masebe.

Nice job, guys.

You’ve seen my occasional grumbling about Warner going out of its way to pull down music videos in which it has some rights from YouTube. Well, it seems they’ve really stepped it up, now:

In early December, Juliet Weybret, a high school sophomore and aspiring rock star from Lodi, Calif., recorded a video of herself playing the piano and singing “Winter Wonderland,†and she posted it on YouTube.

Weeks later, she received an e-mail message from YouTube: her video was being removed “as a result of a third-party notification by the Warner Music Group,†which owns the copyright to the Christmas carol.

[ . . . ]

In addition to Ms. Weybret’s video, family home videos that included a portion of a song playing in the background have been removed, as have any number of videos that use music in goofy ways, from montages to mash-ups.

When a man posted a video of himself using music to teach sign language, the audio was switched off because he lacked the proper copyright clearance to use Foreigner’s 1980s song “Waiting for a Girl Like You.â€

Yeah. Next time you’re tempted to buy a CD or download a track from iTunes/Amazon, check out the publisher/label, and decide if you want to reward this kind of behaviour.

Much longer piece coming on Matt Taibbi’s Rolling Stone article about the mess we’re in, but I had to share this as soon as I read it:

As complex as all the finances are, the politics aren’t hard to follow. By creating an urgent crisis that can only be solved by those fluent in a language too complex for ordinary people to understand, the Wall Street crowd has turned the vast majority of Americans into non-participants in their own political future. There is a reason it used to be a crime in the Confederate states to teach a slave to read: Literacy is power. In the age of the CDS and CDO, most of us are financial illiterates. By making an already too-complex economy even more complex, Wall Street has used the crisis to effect a historic, revolutionary change in our political system — transforming a democracy into a two-tiered state, one with plugged-in financial bureaucrats above and clueless customers below.

Dead on.

So you’ve seen the leaked financial plan from Treasury? Not good:

The Treasury Department is expected to unveil early next week its long-delayed plan to buy as much as $1 trillion in troubled mortgages and related assets from financial institutions, according to people close to the talks.

The plan is likely to offer generous subsidies, in the form of low-interest loans, to coax investors to form partnerships with the government to buy toxic assets from banks.

To help protect taxpayers, who would pay for the bulk of the purchases, the plan calls for auctioning assets to the highest bidders.

Look at that again. To “protect” the taxpayer, they’re going to try to make sure that the highest possible price is paid for these assets. But look at the paragraph before that for how that purchase price is actually paid – with generous subsidies (i.e., taxpayer money). Clever, no? No. Paul Krugman:

To this end the plan proposes to create funds in which private investors put in a small amount of their own money, and in return get large, non-recourse loans from the taxpayer, with which to buy bad — I mean misunderstood — assets. This is supposed to lead to fair prices because the funds will engage in competitive bidding.

But it’s immediately obvious, if you think about it, that these funds will have skewed incentives. In effect, Treasury will be creating — deliberately! — the functional equivalent of Texas S&Ls in the 1980s: financial operations with very little capital but lots of government-guaranteed liabilities. For the private investors, this is an open invitation to play heads I win, tails the taxpayers lose. So sure, these investors will be ready to pay high prices for toxic waste. After all, the stuff might be worth something; and if it isn’t, that’s someone else’s problem.

Or to put it another way, Treasury has decided that what we have is nothing but a confidence problem, which it proposes to cure by creating massive moral hazard.

Krugman too shrill for you? Let’s go to the folks at Calculated Risk:

With almost no skin in the game, these investors can pay a higher than market price for the toxic assets (since there is little downside risk). This amounts to a direct subsidy from the taxpayers to the banks.

And at Naked Capitalism:

So presumably, the point of a competitive process (assuming enough parties show up to produce that result at any particular auction) is to elicit a high enough price that it might reach the bank’s reserve, which would be the value on the bank’s books now.

And notice the utter dishonesty: a competitive bidding process will protect taxpayers. Huh? A competitive bidding process will elicit a higher price which is BAD for taxpayers!

Dear God, the Administration really thinks the public is full of idiots. But there are so many components to the program, and a lot of moving parts in each, they no doubt expect everyone’s eyes to glaze over.

Now watch the noise machine go into full crisis mode, telling us that ThisIsTheONLYWAY.

Today is the beginning of NoRuz. What’s that? Here’s a short cut and paste:

[NoRuz] is the traditional Iranian new year holiday celebrated by Iranian peoples, having its roots in Ancient Iran. Apart from the Iranian cultural continent (Greater Iran), the celebration has spread in many other parts of the world, including parts of Central Asia, South Asia, Northwestern China, the Crimea, and some ethnic groups in Albania, Bosnia, Kosovo and the Republic of Macedonia.

Nowruz marks the first day of spring and the beginning of the Iranian year and is a secular holiday. It is celebrated on the day of the astronomical vernal equinox, which usually occurs on March 21 or the previous/following day depending on where it is observed. As well as being a Zoroastrian holiday and having significance amongst the Zoroastrian ancestors of modern Iranians. According to Encyclopedia Britannica, the Jewish festival of Purim, is probably adopted from the Persian New Year. It is also a holy day for Ismailis, Alawites, Alevis, and adherents of the Bahá’à Faith.

Now, I’m not one for holidays (religious or otherwise), but I can really appreciate a celebration of the Spring Equinox.

(Something tells me that I’ll be getting corrections, shortly . . . )

Marshall writes:

What is so damaging about this isn’t the money — which is almost trivially small compared to the many hundreds of billions we’ve already committed. The problem is what appears to be the president’s mortifying impotence in the face of bankers and financiers who created the problem. The president speaks and acts for the federal government, which is to say, the American people, who have mobilized more than a trillion dollars and all powers of the state to repair the damage emerging out of the financial sector. And with all that, he’s jacked up on a employment agreement between a company the government now owns and derivatives traders who sank the world economy and may quite likely be looking at criminal charges for their activities in the not too distant future?

Anyone can look at that and see that the equation of power and accountability is all screwed up.

Quite.  And really, I hope you’ll click over and read the whole thing. It nails the current state of affairs. Here’s the end:

Whether Geithner and Summers are too close to the people on Wall Street, either through interest or affinity, is an interesting and possibly important question. But fundamentally Obama needs to start showing that he’s in charge, that he’s operating as the American people’s advocate and that he has the power to do it — which these stories of getting jacked up by some Gordon Gecko wannabes in London just terribly undermines. But to do that, to show that, it has to be true. And that might require some real changes in policy and possibly in personnel too.