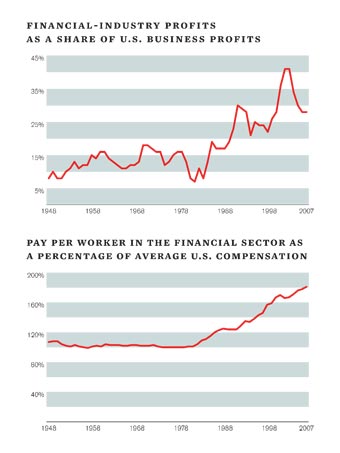

Around September, when this mess was getting some play in the public eye, I used to joke that it wouldn’t be such a bad thing if the financial industry just blew up. That we could rebuild something much better from the pieces than what we had with the present whole. I still say that. I’m not so sure I’m joking all that much anymore. Two graphs, from a story in the Atlantic:

The numbers at the bottom are 10 year terms, starting in 1948. And yes, that uptick starts around 1980. From the article, titled The Quiet Coup, by former IMF chief economist Simon Johnson, is summarized:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform.

Break it. Blow it up. Let’s just have a plan for putting it back together beforehand, yes? And one more suggestion: don’t leave that plan to the people who put us here in the first place. (Of course, that’s the even bigger joke, right there – yes, there’s a problem, but who’s going to fix it? Not the people in power now. This is the hand that fed (and clothed, and housed, and . . .).)